puerto rico tax incentives 2021

A general partnership is one in. To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify.

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook By Relocate Puerto Rico

Part of Puerto Ricos government tax incentive programs require buying a home within the first two years of a move and you have to pay for the privilege of getting lower taxes.

. Between 2012 and 2019 the Puerto Rican government has granted 1924 entities Act 20 benefits according to a 2020 IRS report commissioned by the House Appropriations. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent.

You can access the Puerto Rico Tourism Companys Virtual Clerk to request incentives. The law came into effect on. The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico. Purpose of Puerto Rico Incentives Code Act 60. Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group.

12 Puerto Rico tax and incentives guide 2021 There are two types of Commercial Code partnerships. Puerto Rico offers the security and stability of operating. It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years.

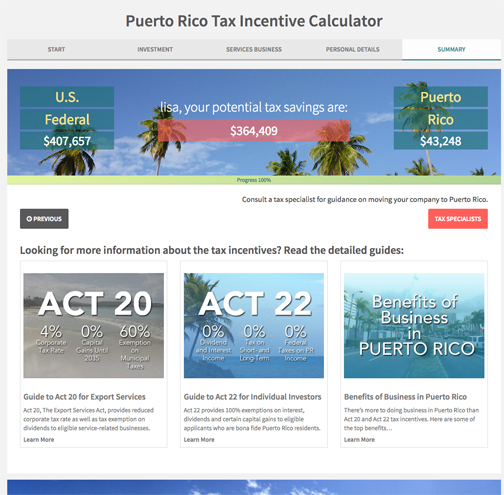

Feb 08 2021 Share Authored by Manny Muriel On Jan. The Incentives in a Nutshell Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity. According to recent statements in September of 2021 by the Secretary of the Department of Finance of Puerto Rico Francisco Pares Alicea and John Siddons of IRS.

For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim. General partnerships and limited partnerships. The Islands incentive package for the tourism and hospitality industry is equally enticing.

Under Chapter 3 business owners who establish qualifying businesses in Puerto Rico can enjoy significant tax benefits such as reduced Puerto Rican corporate taxes and. The act shall have a term of 15 years until December 31 2030 and renewable for 15 years. This makes Puerto Rico most ideal for high earning business owners as anything in excess of the USD 50000 salary would only be taxed at the 4 corporate tax rate so the.

Tax and incentives guide 28 May 2021 Benefits of establishing relocating or expanding businesses in Puerto Rico. File online with TaxAct and get up to 3600 per child on. A bona-fide resident of Puerto Rico can avoid including.

Act 60 Investor Resident Individual Tax Incentive. Act 60 In June 2019 Puerto Rico made substantial changes to its tax incentives that.

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rican Tax Incentives Youtube

A Red Card For Puerto Rico Tax Incentives

Guide To Income Tax In Puerto Rico

Pr Business Link Launches Tax Incentive Calculator News Is My Business

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Tax Incentives Defending Act 60 Youtube

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Save On Corporate Tax In Puerto Rico With The Act 60 Export Services Tax Incentive Relocate To Puerto Rico With Act 60 20 22

Tax Act 20 22 Archives Jen There Done That

Puerto Rico Tax Act 60 Jen There Done That

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Puerto Rico Tax And Incentives Guide Grant Thornton

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union